There are no one-size-fits-all credit decisioning solutions. Make sure your partner uses multiple, integrated data sources to ensure you are leveraging the correct data to make solid lending decisions. Of course, analytic capabilities are of little help without the right data. In today’s environment, lenders need to be nimble and constantly evaluate their performance, analytics can help. The balance highlights how many lenders use analytics to help manage risk, streamline loan approvals, and improve their target marketing. You should look for a credit risk management provider that is an extension of your team for your analytics strategy. Lenders don’t just need a vendor of decision engine software, they need a partner.

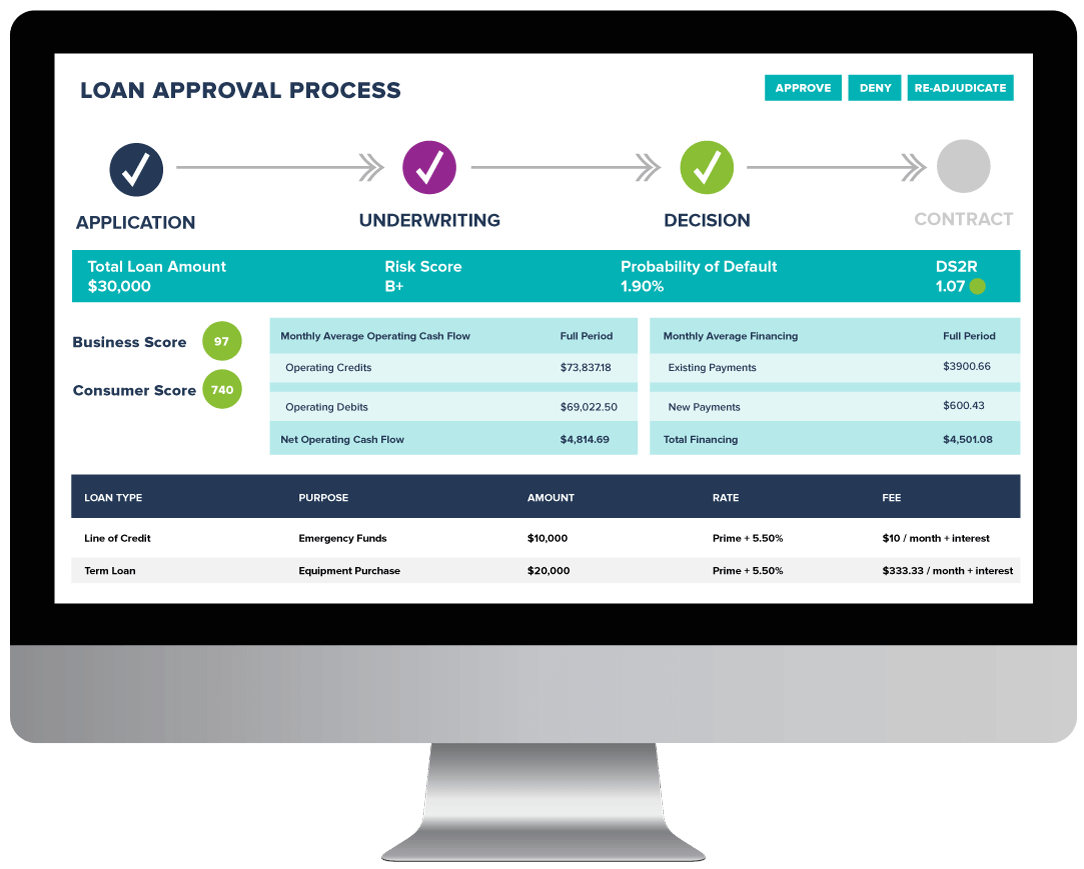

A decision engine that can accommodate more applications, different credit policy changes and changing internal workflows is essential as your business grows. This is why it’s important to ensure the solution you invest in is scalable. From lulls in borrowing and sudden spikes due to economic conditions and trends, you need an engine that can easily adjust to the ebbs and flows of the business. You understand just how quickly the lending landscape changes. Furthermore, you will want to know how fast the engine can adjust to credit policy changes. When choosing a credit decision engine, you should see how quickly it can be implemented, tested, and deployed. However, it’s not just the end product that should be quick. The biggest benefit of investing in a decision engine is the ability to monitor applicants’ credit risk in real-time. Here are must-haves for decision engine software: 1. Financial institutions need a unique solution that fits their workflows and industry standards.

#Bank loan risk engine software#

Like any technology, not all decision engine software is created equal. 7 things you need in a credit decisioning engine

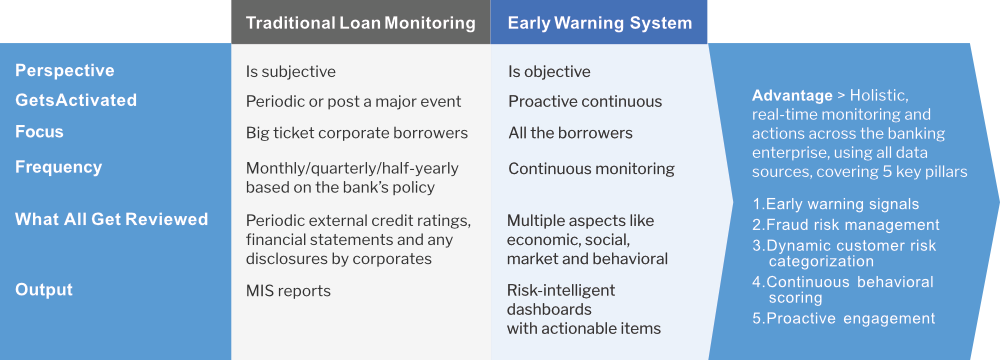

Aided by an engine equipped with automated decision making, lenders can process hundreds of digital loan applications daily while managing risk in real-time. By reducing reliance on IT professionals, business users can rapidly test and deploy risk strategies on their own. This is where decision engine software comes into play. Perhaps even more importantly, modern systems must work in real-time to continuously monitor risk and portfolios while delivering personalized marketing to borrowers. Of course, to get to this state, a lender must reevaluate their internal processes and often change them to incorporate automation and more data. Partners, customers, and lenders can effortlessly connect when needed through application programming interfaces for an experience unlike any they could receive in a brick-and-mortar location. By using digital-first business models akin to Amazon, the publication sees the future of lending as being completely web-based. However, legacy systems and infrastructure often hinder a lender’s ability to provide a seamless digital borrowing experience.Īn article by American Banker highlights this roadblock, but also offers a solution: Updated decision engines and models.

Today’s borrowers - no matter what type of credit they’re seeking - want a straightforward, fast, and personalized lending experience, and many lenders desire the same because it can improve their portfolio. Decision engine software for a seamless borrowing experience Every lender can benefit from an agile decision engine solution that leverages data and analytics for efficient and compliant decision making. These are challenges for any lender who wants to optimize the entire credit lifecycle, but there’s a solution. Borrowers expect an instant, digital experience, the competition is becoming more sophisticated, and existing software is limiting necessary innovation.

0 kommentar(er)

0 kommentar(er)